Business News

Why You Must Not Opt For a Credit Card Advance?

Let’s say you have an urgent cash requirement. A card swipe, a cheque or a balance transfer won’t do; only hard cash will suffice the purpose. Unfortunately, though, you do not have enough cash. Your debit card doesn’t have the requisite funds and the nature of the emergency is such that you do not have enough time to borrow a Personal Loan. So what do you do then? “Oh wait! I do have a Credit Card in my wallet! I can always withdraw cash from it, right? Problem solved!” is the riposte most of you may come up with. But hang on a second! Despite how easy and convenient as it sounds, a Credit Card cash withdrawal may not be such a good idea. To spell it out more clearly, it would do more harm than good for you. Wait, what? Yes! You read that right! Read on to find out just why.

No interest-free grace period

Your Credit Card bills get generated on a fixed date every month. Let’s say if the date were the 5th of every month, then the bill for all your transactions from 5th of July to the 4th of August would be raised on the 5th August (the billing date). You are not liable to pay any amount in the form of interest for Credit Card purchases and bill payments before they are billed. Besides this, you usually get a 21 to 25 day interest-free grace period which commences from the billing date. Any amount you repay during this period becomes interest-free. So in effect, you get to enjoy a 25 to 50 day interest-free period from the day you make a transaction from your SBI Credit Card or other Credit Card.

This, however, does not apply to cash withdrawals. A Credit Card cash advance denies you the privilege of enjoying an interest-free period. Moreover, the interest on the borrowed amount gets accrued right from the day you make the withdrawal and not from the billing date. And considering that Credit Card interest rates are about 2.5% per month, you would probably pay interest at the rate of 5% or above in that 25-50 day period which would have otherwise been interest-free.

You could, however, expect some sort of relief if you own a low interest bearing Credit Card. You could apply for Credit Cards Online in India on www.mymoneymantra.com, India’s leading online financial service provider and the premier destination for ‘low interest, high limit’ Credit Cards. Their team of professional selects only the Top Credit Cards for you to ensure that you enjoy maximum credit facility at minimum interest rates.

Higher interest rate

Not many people know this, but a Credit Card cash advance bears a higher interest rate than other Credit Card transactions. The interest rate on cash withdrawals may vary from 24% to 48% depending upon the card issuer. In contrast, all other Credit Card transactions carry an interest rate of 12% to 36%. The difference is about 1% per month; a considerable amount by any standards. So not only do you pay interest for a longer time, but you also pay it a higher rate. Needless to say, the affordability of the transaction takes a serious hit!

Hefty transaction fees

If the absence of an interest-free duration of time and a higher interest rate didn’t do enough to convince you of the impracticality and unaffordable nature of a Credit Card cash advance, here’s something more. A Credit card cash advance imposes a hefty transaction fee on you. The transaction fee is usually 2.5% of the amount withdrawn but some card issuers may charge 3% too. This one-time payment is over and above the interest charged on the withdrawal.

If you were to combine the exorbitant interest rate and the transaction fees, you’d have to repay 8-10% more than the amount you borrowed if you were to make the repayment within 2 months from the transaction date. And that is about as much as a Fixed Deposit would pay you in a year. Just saying!

It may hurt your credit score

Let’s just keep the financial viability of this practice aside for a moment. Credit Card cash advances cause more problems than just that. You’d usually take a cash advance as a last resort. And the fact that you ‘had’ to use it, which implies a paucity of funds and a lack of low-interest alternatives, sends out bad signals to your lenders. Utilising your credit limit to its maximum is also not viewed in great light. These factors may decrease your creditworthiness and hence your credit score.

Alternatives for cash advances

Before you walk down to the nearest ATM to take a cash advance on your card, take some time out to consider other alternatives. See if you can borrow a Personal Loan. If you have some unused furniture or other such spare items, sell them off. Ask your friends and family members if they could help.

If your car breaks down and the mechanic won’t accept card payment, or if there’s some sort of a medical emergency and you have not carried your debit card along; a cash advance becomes more of a compulsion than an option. Such situations aside, you are better off staying as far away from a cash advance as you possibly can!

Also Read: 5 Best Credit Cards for Salaried Individuals in India

To apply online for Credit Cards, Secured Loans and Unsecured Loans, visit www.mymoneymantra.com, the leading online lending marketplace that offers financial products from 60+ Banks and NBFCs. We have served 2 million+ happy customers since 1989.

Talk to our Loan Specialists toll-free at 1800 103 4004 to know more about our products and offers.

Business News

Uber Alternatives: 10 Ride-Sharing & Similar Applications

With online cab booking services becoming an integral part of our lives, Uber Alternatives has introduced the service that has dominated the market since its introduction. With vast cab services and taxes being made in cities and countries worldwide, Uber has ranked in the cab market with one of the largest services.

Although Uber has been rated as one of the largest cab booking services, it lacks some of its features like Uber Driver, Surge Pricing, automated system, and a couple of others. Hence, for your convenience, in this article, we have mentioned the 10 alternatives of Uber that can help you choose the best cab services.

What is Uber Alternatives ?

Uber Technologies, is a multinational transportation company that is incorporated with services like raid-hailing services, food delivery, freight transportation, and courier services.

Founded in 2009, Garrett Camp came up with the idea to create Uber and spent $800 hiring a private driver on the business eve.

With the largest ridesharing company worldwide with more than 150 million monthly active users and more than 6 million drivers, Uber guarantees to facilitate more than 26 million rides a day and more than 46 billion drives since its foundation in 2010.

How Uber Will Face Challenges in The Upcoming Years?

Although Uber is an esteemed company that has provided cab services for years, its reputation has gradually declined in recent years owing to the several challenges they are facing or is likely to face shortly.

1. Status of Drivers

One of them is the status of drivers; whether they are classified as personnel or independent drivers. Uber, to maintain its safe side, opts for the latter, and classifies itself as a technology company whose sole purpose is to connect drivers and passengers.

Although this classification works smoothly for the company and some of the drivers, others have reported to be suffering from it. Many drivers claim that they have been paid minimum wages which do not meet the earnings they can do by working as independent drivers. Not only this, but the company, Uber, has been solving several lawsuits that have been launched by drivers in Massachusetts and California.

2. The California Controversy

The ongoing challenges with the status of drivers faced legislative challenges in California; the region’s population of 39 million makes it one of the largest marketplaces for the company. Following, in 2019, the California senate passed an Assembly Bill 5, that ordered Uber, and Lyft among other ridesharing to deal with their drivers as employees and not independent contractors.

3. Taxes

Another issue that is related to the status of the drivers is the tax issue. If Uber stops claiming itself as a technology company and becomes a livery company, the government can claim that the entire ride payment is Uber Alternatives revenue and is subjected to taxes and governance.

4. Driver’s Risk

Besides, Uber drivers have been subjected to several risks as the company has been banned in several regions. In such cases, Uber drivers are open to receiving threats from the regions and their independent drivers.

Additionally, the Airport authorities have also been cracking down on Uber to drop off and pick up customers from the airport.

5. The Risk of International Expansion

Since Uber has now expanded its services and is now available across Asian countries, it might face issues with the local drivers.

Not only has there been an urge to promote local businesses, but the taxis are more affordable and compatible with customers. In such cases, Uber’s global expansion has sought to arouse several challenges in recent years.

10 Best Uber Alternatives In 2024

1. Flywheel

A cab-related service, similar to Uber, is currently working in San Francisco and is also one of the oldest cab services in the area. Flywheel, unlike Uber, is positively reviewed for its well-behaved drivers and clean cats.

Besides cab services, they have the second largest fleet of wheel car-based taxis and drivers that are trained for ease to passengers.

2. Grab

A Southeast Asian application, Grab is a great alternative to Uber Alternatives; however, has a plethora of features to offer. Initiated in Malaysia in 2012, besides its cab services, the company offers food and grocery delivery services, and mobile payments among others. With a simplified user interface and customer service assistance, Grab, with few taps, offers you a plethora of services that include purchasing groceries, ordering food, and much more.

Currently, Grab is operating its services in more than 400 cities. Additionally, Grab supports local businesses by including a list of restaurants and grocery stores that provide with several services to users.

3. HopSkipDrive

With considerable transportation that provides services to children and older adults. Currently operating in the United States in its 13 states, it currently operates primarily for school-aged children who fall under the category of IEP or the McKinney – Vento Homeless Assistance Act.

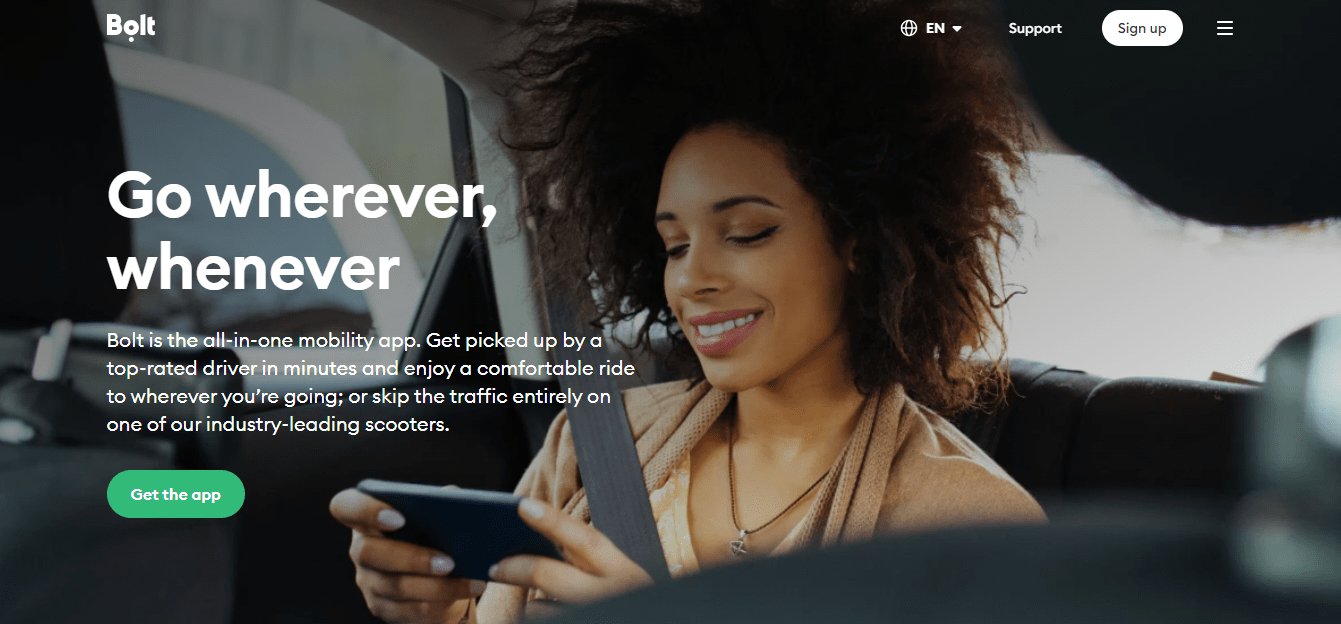

4. Bolt

Bolt, founded in 2013 in Estonia as Taxify is a transportation network organisation that operates in over 50 nations internationally. It offers convenient and low-cost experience hailing offerings to its customers. The organisation focuses on offering competitive pricing for its rides. The pricing model of the enterprise is designed in such a manner it is low-priced for both the riders and the drivers. The well-represented application allows customers to e-book rides, music their motive force’s place and pay for the rides seamlessly. Bolt is dedicated to safety and has implemented several measures to ensure the proper being of its riders and drivers.

One of the excellent Uber Alternatives options alternatives for commuters and vacationers in numerous countries including Europe, Africa, Asia and Latin America. Bolt can be a beneficial alternative to Uber if you are looking for an alternative to Uber with a motive of transportation for your family and education. The core values that are posed by Bolt are safety, empathy, ownership, thinking a bigger hustle, a brighter tomorrow, and positivity.

5. Gett

An Israeli company, Gett, with its established features and an easy interface, has made itself popular in the cab and taxi-sharing market.

Initially, the app was named GetTaxi and the only services it provided were related to taxis. However, with its globalisation, Gett also includes B2B travel management that shows versatility in its plethora of operations.

As of 2024, Gett has a strong presence in the United States, United Kingdom, and Israel. Now, with its appropriate corporate offerings, Gett is ready to expand itself in other markets across the globe.

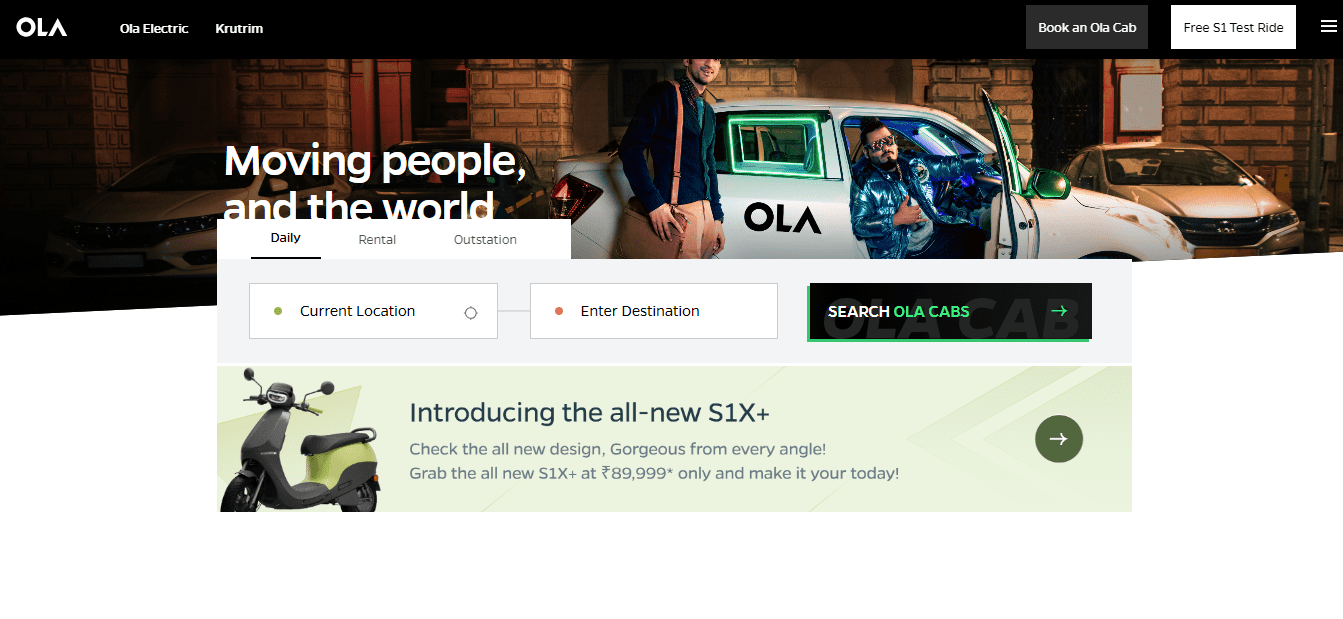

6. OLA

An Indian multinational ride-sharing company, the term ‘OLA’ is styled as OLΛ. With its headquarters in Bengaluru, India, in 2010, the company was initiated as a trip-planning company. However, in 2011, with the growing market of cab-related services, its founder, Bhavesh Agarwal, decided to make a smooth transition that eventually led him to a successful way to gain a global market share.

Now as of 2024, OLA has not only expanded its service in India but also in several countries including Australia, New Zealand, and The United Kingdom.

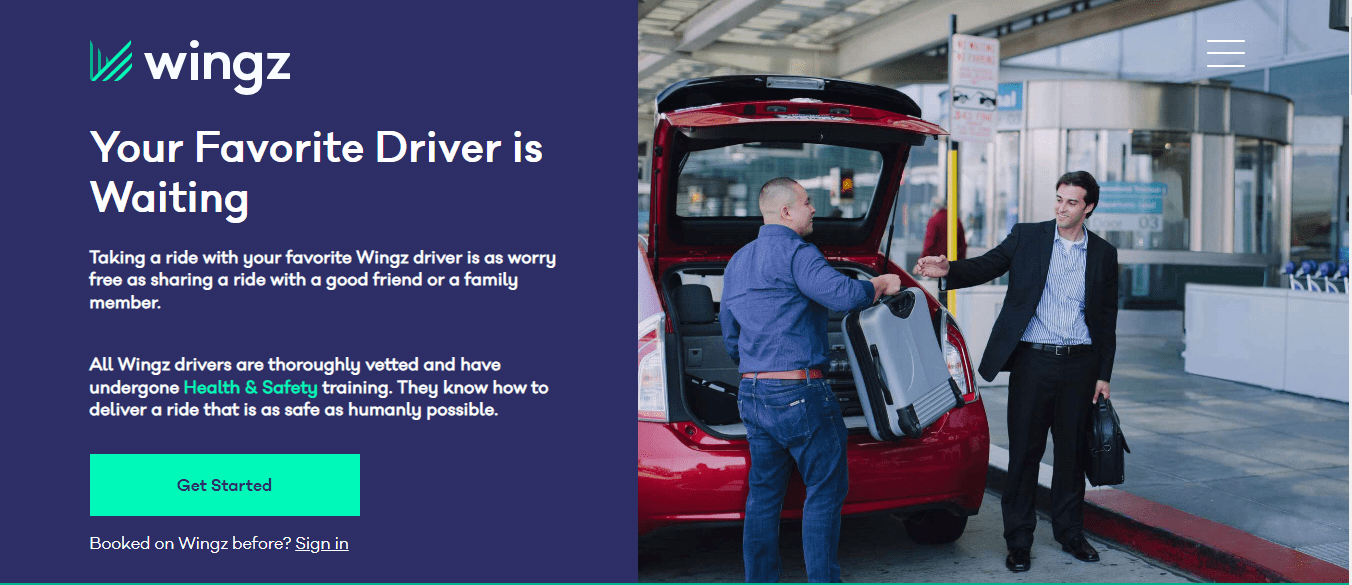

7. Wingz

Besides its services of allowing users to book prior, its charges are fixed which helps users in not receiving a surge fee after arriving at the airport.

A US-based ride-hailing service, Wingz predominantly serves pre-scheduled, flat-fee, private rides that are particular for airport transfers.

Not only this, but Wingz lets riders and users request their favourite drivers for a hassle-free drive. With a safety feature and several customisation options, it serves as a great alternative to Uber Alternatives in 2024.

8. Via

A New York-based company, Via has now expanded its service globally and operates in more than 20 countries with its unique, ride-sharing opportunities.

Via uses an algorithm that matches passengers that are heading in the same direction which helps reduce the number of cars on the road while lowering the cost of a person. Additionally, with its unique ride-sharing option, it can be counted as one of the most sustainable Uber substitutes in the market.

9. Cabify

Operated mainly by a Spanish ride company, Cabify operates mainly in Spain, Latin America, and a few parts of Europe.

While the company is committed to safety, Cabify represents a comfortable drive to its customers, transparent pricing, and high-quality and trained drivers. Unlike Uber Alternatives, Cabify has reported few safety incidents and is continuing to improve to provide more safe services. While Cabify is safely running in regions across Spain, Latin America, and regions of Europe, it is constantly working to expand its services across Asian regions.

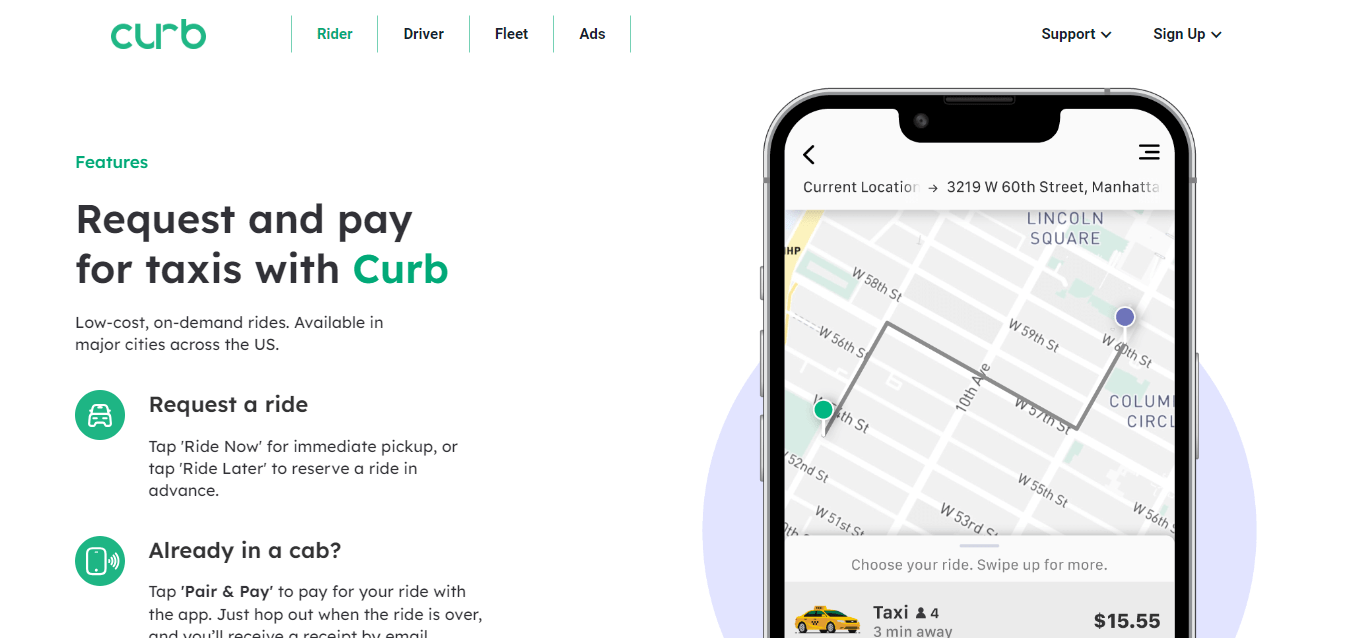

10. Curb

A US-based company that connects with riders and professional drivers, Curb is another reliable alternative to Uber.

With its new age reliability of tech-led Taxi applications, it combined the traditional taxis, which is why it is considered unique.

Along with its instant service, Curb also allows users to book their taxis in advance. In collaboration with the old taxis, Curb is supporting old-school businesses and local employees that can cash on modern-day cab services.

Final Words

Uber, urstoryiq.com with more than 47 billion rides since its inception in 2010, is likely to continue its contribution to the ride-sharing business. However, owing to several legal actions and controversies emerging around Uber Alternatives name have sabotaged its established market. In such cases, many users and customers have preferably switched their platforms to a safer and less controversial ride-sharing and cab services application.

Hence, if you are also looking for an alternative ride-hailing service to Uber, you can prefer our above-mentioned much-coveted guide. In this guide, we have covered everything including the reasons Uber is facing a setback from its customers, users, and drivers, and also the 10 alternatives of Uber in 2024 that can be used for a safer ride.

See also : From Me To You: Kimi Ni Todoke Season 3 Renewed At Netflix

News

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi | इन्ना लिल्लाही व इन्ना इलैही राजिऊन का मतलब

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi :- दोस्तों आपने कभी ना कभी मुसलमान समाज के लोगों को ” Inna Lillahi Wa Inna ILayhi Rajioon ” कहते अवश्य सुना होगा और आपके मन में यह ख्याल आया होगा कि आखिर ” Inna Lillahi Wa Inna ILayhi Rajioon ” क्या है और ” Inna Lillahi Wa Inna ILayhi Rajioon ” का उच्चारण कब किया जाता है या फिर ” Inna Lillahi Wa Inna ILayhi Rajioon ” को कब पढ़ा जाता है।

अगर आपको ” Inna Lillahi Wa Inna ILayhi Rajioon ” के बारे में तनिक भी जानकारी नहीं है और आप इससे जुड़ा हर एक जानकारी प्राप्त करना चाहते हैं तो आप हमारे इस लेख के साथ अंत तक बने रहे। क्योंकि इस लेख में हम ” Inna Lillahi Wa Inna ILayhi Rajioon ” से जुड़ी हर एक जानकारी प्रदान करने वाले हैं तो चलिए शुरू करते हैं इस लेख को बिना देरी किए हुए।

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi | इन्ना लिल्लाही व इन्ना इलैही राजिऊन का मतलब

दोस्तों “Inna Lillahi Wa Inna ILayhi Rajioon” एक उर्दू शब्द है इसका अर्थ हिंदी भाषा में “हम अल्लाह के हैं और हमें अल्लाह के पास वापस लौट के जाना है” होता है। सरल शब्दों में कहें तो इसका अर्थ होता है कि हम अल्लाह के बंदे हैं हमें अल्लाह ने बनाया है और हमें एक ना एक दिन अल्लाह के पास वापस लौट के जाना है।

दोस्तों आपको मालूम होगा कि यह दुनिया में जितने भी सजीव प्राणी है वह एक सीमित समय के लिए धरती पर आए हुए हैं। उनका जीवनकाल कभी भी समाप्त हो सकता है जो व्यक्ति यहां पर आया है उसे जाना निश्चित है। हालांकि कुछ व्यक्ति कम समय मे ही अल्लाह के पास चले जाते है और कुछ व्यक्तियों को अल्लाह के पास जाने में कई वर्षों लग जाते हैं। यह सब अल्लाह के ऊपर निर्भर करता है, की अल्लाह किस बंदे को अपने पास कब बुलाना चाहते है।

“Inna Lillahi Wa Inna ILayhi Rajioon” शब्द अर्थ कुछ इस प्रकार से भी होता है । जैसे कि :-

- हम अल्लाह के हैं और उसी की ओर लौटेंगे ।

- अल्लाह ने हमें बनाया है और वापस हमें उनके पास जाना है।

- हम अल्लाह द्वारा भेजे गए सिपाही हैं जिन्हें वापस लौट के अल्लाह के पास जाना है।

Inna Lillahi Wa Inna ILayhi Rajioon क्या है ?

Inna Lillahi Wa Inna ILayhi Rajioon “इन्ना लिल्लाही व इन्ना इलैही राजिऊन” यह इस्लामिक समाज के पाक किताब कुरान का एक आयत है।

Inna Lillahi Wa Inna ILayhi Rajioon कब पढ़ा जाता है ?

दोस्तों हमने ऊपर के टॉपिक में जाना कि आखिर “Inna Lillahi Wa Inna ILayhi Rajioon” का मतलब क्या होता है और “Inna Lillahi Wa Inna ILayhi Rajioon In Hindi” क्या होता है। अब हम इस टॉपिक के माध्यम से जानेंगे कि आखिर “Inna Lillahi Wa Inna ILayhi Rajioon” कब पढ़ा जाता है या “Inna Lillahi Wa Inna ILayhi Rajioon” का उपयोग कब किया जाता है तो चलिए शुरू करते हैं इस टॉपिक को बिना देरी किए हुए।

जब मुस्लिम समाज में किसी भी व्यक्ति का इंतकाल हो जाता है या फिर कोई व्यक्ति किसी चहेते का इंतकाल का खबर सुनता है तब वह इस “Inna Lillahi Wa Inna ILayhi Rajioon” वाक्य का उच्चारण करता है। इन शब्दों का मतलब तो हमने आपको ऊपर में बता ही दिया है।

ऐसा जरूरी नहीं है कि जब किसी भी व्यक्ति का इंतकाल होगा तभी इस शब्द का उच्चारण किया जाएगा आप इसे अपने परेशानी के वक्त भी उपयोग कर सकते हैं। उदाहरण के तौर पर :- मान लीजिए कि आपके पास कोई फोन है या फिर आपके पास कोई कीमती चीज है और अगर आप उसे खो देते हैं तो उस परिस्थिति में भी आप इस शब्द का उच्चारण कर सकते हैं। क्योंकि इस शब्द का अर्थ ही होता है कि ” यह अल्लाह का है और इसे अल्लाह के पास ही लौटना है।

FAQ, s

Q1. inna lillahi wa in allah-e-rajioon in arabic

Ans. inna lillahi wa in allah-e-rajioon को arabic में ” إنا لله وعلينا أن نعود إلى الله ” कहते है।

Q2. inna lillahi wa in allah-e-rajioon in Urdu

Ans. inna lillahi wa in allah-e-rajioon को Urdu में ” ہم اللہ کے ہیں اور ہمیں اللہ کی طرف لوٹنا ہے۔ ” कहते है।

Q3. inna lillahi wa inallah-e-raji’oon meaning in English

Ans. inna lillahi wa inallah-e-raji’oon meaning in English is ” We surely belong to Allah and to Him we shall return “.

Watch This For More Information :-

[ Conclusion, निष्कर्ष ]

दोस्तों आशा करता हूं urstoryiq.com कि आपको मेरा यह लेख बेहद पसंद आया होगा और आप इस लेख के मदद से Inna Lillahi Wa Inna ILayhi Rajioon in hindi के बारे में जानकारी प्राप्त कर चुके होंगे।

हमने इस लेख में सरल से सरल भाषा का उपयोग करके आपको Inna Lillahi Wa Inna ILayhi Rajioon के मतलब के बारे में बताने की कोशिश की है।आप हमारे दिए गए कमेंट सेक्शन में अपनी राय जरूर दें कि आपको यह लेख कैसा लगा और आपको Inna Lillahi Wa Inna ILayhi Rajioon शब्द का अर्थ समझ में आया कि नहीं।

See also : Aas Pas Kahan-Kahan Restauant Maujud Hai

News

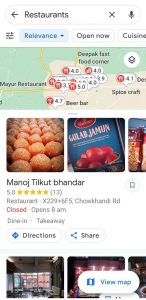

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं – Aas Pas Kahan-Kahan Restauant Maujud Hai

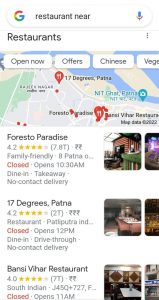

Aas Pas Kahan-Kahan Restauant Maujud Hai :- दोस्तों यदि आप भी इंटरनेट पर एक अच्छे रेस्टोरेंट की तलाश कर रहे हैं और जानना चाहते हैं कि आखिर आपके पास में कौन से सबसे अच्छे रेस्टोरेंट हैं तो हम आपको इस आर्टिकल में यही बताएंगे कि आपके आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? तो यदि आप जानना चाहते हैं और उस रेस्टोरेंट में खाना खाने जाना चाहते हैं तो इस आर्टिकल को पूरा अंत तक जरूर पड़े तभी आपको अपने पास के रेस्टोरेंट तलाश कर पाएंगे तो बिना किसी देरी के चलिए शुरू करते हैं इसलिए को और जानते हैं उन सभी रेस्टोरेंट्स ओं के बारे में जो कि आप के सबसे पास मौजूद हैं।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं?

दोस्तों यदि आप अपने आसपास के रेस्टोरेंट तलाश कर रहे हैं और जानना चाहते हैं कि आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? तो हम आपको इस टॉपिक में कुछ स्टेप्स बताएंगे जिसकी मदद से आप अपने पास के रेस्टोरेंट को तलाश कर सकते हैं तो सभी स्टेप्स को ध्यान से पढ़ें और चली जानते हैं।

Step 1. आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं यह जानने के लिए सबसे पहले आप गूगल मैप एप्लीकेशन को ओपन करें।

Step 2. Google map एप्लीकेशन को ओपन करते हैं अब आपको उपर सर्च बॉक्स के नीचे एक रेस्टोरेंट्स का ऑप्शन दिखाई देगा।

Step 3. उस restaurant वाले ऑप्शन पर क्लिक करें। restaurant के ऑप्शन पर क्लिक करते ही अब आपके सामने एक पेज ओपन होगा।

Step 4. इस पेज में आपको आपके आसपास के सभी restaurant दिखाई देंगे जो कि गूगल पर listed होंगे। तो आप वहां देख सकते हैं कि आप के सबसे पास वाले restaurant कौन है और कौन से restaurant आपको पसंद है।

तो इस प्रकार से आप अपने पास के रेस्टोरेंट खोज सकते हैं हमें उम्मीद है कि आपको यह तरीका पसंद आया होगा और आप इस तरीका के मदद से रेस्टोरेंट को तलाश कर पाएंगे।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? (दूसरा तरीका)

Aas Pas Kahan-Kahan Restauant Maujud Hai दोस्तों यह दूसरा तरीका मैं बताऊंगा जिसके माध्यम से भी आप आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं यह जान सकते हैं और आसानी से किसी भी रेस्टोरेंट में खाने जा सकते हैं तो चलिए जानते हैं।

Step 1. अपने आसपास के रेस्टोरेंट जानने के लिए आपको सबसे पहले अपने मोबाइल फोन को ओपन करना है और उसके बाद गूगल में चले जाना है।

Step 2. गूगल में चले जाने के बाद अब आपको सर्च बॉक्स में restaurant near me लिखकर सर्च करना है।

Step 3. restaurant near me लिखकर सर्च करते हैं अब आपके सामने जो भी रेस्टोरेंट मौजूद होगा वह आपके मोबाइल फोन के स्क्रीन पर 400 मीटर के अंदर के सभी restaurant आ जाएगा।

Step 4. आप वहां से देख सकते हैं कि कौन रेस्टोरेंट कितना दूर है और आपके आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? और आप वहां पर देख सकते हैं कि कौन रेस्टोरेंट अभी खुला है और कौन बंद है।

दोस्तों अब हमें उम्मीद है कि अब आपको इस दूसरे तरीका के मदद से पता चल गया होगा कि आस-पास रेस्टोरेंट कहां मौजूद है और कैसे खोजा जाता है क्योंकि यह सबसे आसान तरीका था जिसकी मदद से आप अपने पास के रेस्टोरेंट को खोज सकते हैं।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? गूगल से पूछो

Aas Pas Kahan-Kahan Restauant Maujud Hai यह जानने का तीसरा और आखिरी तरीका है कि आप गूगल से पूछें कि गूगल बताओ मेरे आस-पास रेस्टोरेंट कहाँ हैं?

Step 1. तो गूगल के मदद से रेस्टोरेंट का पता जानने के लिए आप सबसे पहले गूगल असिस्टेंट को अपने मोबाइल फोन में डाउनलोड करें।

Step 2. गूगल असिस्टेंट को डाउनलोड करने के बाद अब उसे अपने मोबाइल फोन में ओपन करने के लिए आप नीचे दिए गए होम के बटन को दबाए रखें।

Step 3. उसके बाद अब आपके मोबाइल फोन में गूगल असिस्टेंट ओपन हो जाएगा अब आप गूगल असिस्टेंट से पूछे कि गूगल आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं?

यह सवाल पूछने पर अब गूगल असिस्टेंट आपको आपके आसपास के सभी रेस्टोरेंट दिखा देगा। आप वहां पर अपने मन मुताबिक किसी भी रेस्टोरेंट को चुन सकते हैं और उसके दूरी को पता लगा सकते हैं।

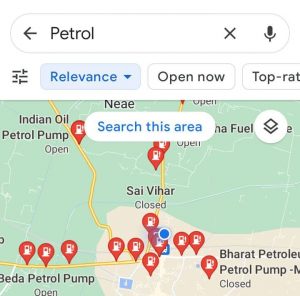

नजदीकी रेस्टोरेंट तक ड्राइव करके जाने का रास्ता बताओ

दोस्तों यदि आप गाड़ी से हैं और नजदीकी रेस्टोरेंट जाने के लिए ड्राइव वाली रास्ता तलाश रहे हैं तो इसके लिए आप गूगल मैप एप्लीकेशन का मदद ले सकते हैं इसमें बस आपको Google Map एप्लीकेशन को ओपन करना है और ऊपर दिए गए रेस्टोरेंट के ऑप्शन पर क्लिक कर देना है।

Aas Pas Kahan-Kahan Restauant Maujud Hai उसके बाद आपके सामने बहुत सारे रेस्टोरेंट आ जाएंगे अब आप जिस भी रेस्टोरेंट्स तक जाना चाहते हैं उस रेस्टोरेंट्स के direction वाले बटन पर क्लिक करें। direction वाले ऑप्शन पर क्लिक करते ही हैं अब आपको ड्राइव करने का वाला रास्ता दिखाई देगा। आप उस रास्ता से ड्राइव करके उस पास के रेस्टोरेंट तक जा सकते हैं।

FAQ,s

1 . क्या आस-पास में कोई मेक्सिकन रेस्टोरेंट है?

Ans :- दोस्तों यदि आप मैक्सिकन खाना खाना चाहते हैं और ढूंढ रहे हैं मेक्सिकन रेस्टोरेंट तो इसके लिए आप Google Map का इस्तेमाल कर सकते हैं। बस आपको गूगल मैप पर जाना है और सर्च बॉक्स में Mexican restaurant लिखकर सर्च कर देना है इतना करने के बाद अब आपके आसपास के मौजूद मेक्सिकन रेस्टोरेंट आ जाएगा। अब आप वहां पर जाकर मैक्सिकन खाना खा सकते हैं।

2 . आस-पास मौजूद कॉफ़ी शॉप ढूँढो

Ans:- दोस्तों यदि आपको भी कॉफ़ी दीवाने हैं और खोज रहे हैं कॉपी के सबसे पास के रेस्टोरेंट तो इसके लिए गूगल ओपन करें और उसके सर्च बारे में coffee shop near me लिखकर सर्च करें। सर्च करने के बाद अब आपके सामने आपके नजदीकी कॉफी शॉप आ जाएंगे। अब आप वहां पर जाकर कॉफी पी सकते हैं और कॉफी का मजा ले सकते हैं।

3 . गूगल आस-पास के रेस्टोरेंट बताओ?

Ans :- दोस्तों यदि आप अपने आसपास के रेस्टोरेंट पता करना चाहते हैं तो आप गूगल असिस्टेंट के माध्यम से आसानी से पता कर सकते हैं इसके लिए बस आपको गूगल असिस्टेंट को ओपन करना है और गूगल से यह सवाल पूछना है उसके बाद गूगल आपको आपके आसपास के सभी रेस्टोरेंट की list आपके सामने ला देगा।

4 . मेरे आस-पास के सबसे अच्छे रेस्टोरेंट दिखाओ

Ans :- दोस्तों अगर आप अपने आसपास के सबसे अच्छे रेस्टोरेंट खोज रहे हैं तो उसे आप गूगल से आसानी से पता कर सकते हैं बस आपको गूगल पर जाकर सर्च करना है near me best restaurant उसके बाद आपके सामने अच्छे अच्छे रेस्टोरेंट आज आएंगे जो आप के आस पास होंगे.

अंतिम विचार

दोस्तों हमें उम्मीद है urstoryiq.com कि आप इस लेख के माध्यम से अपने आसपास के सबसे नजदीकी रेस्टोरेंट को खोज पाए होंगे क्योंकि हमने इसलिए की वजह से आपको यह बता दिया हैAas Pas Kahan-Kahan Restauant Maujud Hai और हमें उम्मीद है कि आप भी जान चुके होंगे. तो यदि आप इस आर्टिकल से कुछ नया सीखे हैं तो इस आर्टिकल को दोस्तों के पास शेयर जरूर करें…धन्यवाद

See also : Buri Nazar Se Bachne Ki Dua

-

Technology6 years ago

Developing Workplace Face Recognition Devices and Controls

-

Business News5 years ago

Business News5 years agoFacts to know about commercial closing

-

Home Advice6 years ago

Things to Remember When Shopping For Recycled Plastic Adirondack Chairs

-

Technology6 years ago

Use WhatsApp Web Login on PC

-

Entertainment6 years ago

Meanings of WhatsApp Symbols, Emoticons

-

Education5 years ago

Education5 years agoHuman Body And Its Interesting Features

-

Entertainment6 years ago

Ganesh Chaturthi Songs (Mp3, DJ Songs, Remix) Ganpati Songs Free Download

-

Sports News4 years ago

Sports News4 years agoHow to Build a Perfect Fantasy Cricket Team?