Business News

Factors to Check When Choosing a Surety Bond Agency

With the construction business still in its recovery stages, competition is fierce for the few jobs that are out there. This has also increased the focus on public construction jobs. The advantage of such projects is their reliability and the seal of trustworthiness they can provide on any contractor’s CV. However, public projects almost always require a surety bond and this means looking for the right surety bond Georgia firm.

There are a thousands of firms that offer surety bonds these days. However, not all surety bonds are the same. Many of them are just insurance firms which just dabble in surety. It is important that you select the right agency for you. This could save you money and time — both extremely valuable when construction deals become tricky.

Approval and access

As mentioned above, some surety bond agencies are just offshoots of larger insurance companies that offer surety services. However, this is a specialist service and an agency which does not specialize in surety services may not have the requisite knowledge and expertise in the area. This can sometimes end up in unnecessary waste of time and money. You must also check with the US Treasury Department if the agency is licensed for bonding. Some firms that are not licensed usually broker it to another agency instead of completing the work in-house. This means increased costs and a longer turnaround time.

Choose a reputable firm

If you are in the construction business, chances are that you already know if reputable and reliable firms in the area. A firm gets a positive reputation among contractors by proving that it stands by them. A surety bond firm is more than just a banking or insurance firm. The surety is also indicative of a contractor’s trustworthiness and a good surety firms will always defend the contractor against unfair claims. A reputable surety firm will also have high acceptance among government or private companies offering construction jobs, which improves your chances of winning a bid.

Investigation

How thorough is the agency in checking your credentials? A reliable and reputable agency will make sure that every aspect of the contractor’s business is thoroughly checked, including their current liabilities, credit history, running projects and so on. The investigation is carried out to ensure the contractor is able to stick to the project. Hence, a surety bond Georgia firm that conducts a thorough investigation is always a good sign.

News

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi | इन्ना लिल्लाही व इन्ना इलैही राजिऊन का मतलब

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi :- दोस्तों आपने कभी ना कभी मुसलमान समाज के लोगों को ” Inna Lillahi Wa Inna ILayhi Rajioon ” कहते अवश्य सुना होगा और आपके मन में यह ख्याल आया होगा कि आखिर ” Inna Lillahi Wa Inna ILayhi Rajioon ” क्या है और ” Inna Lillahi Wa Inna ILayhi Rajioon ” का उच्चारण कब किया जाता है या फिर ” Inna Lillahi Wa Inna ILayhi Rajioon ” को कब पढ़ा जाता है।

अगर आपको ” Inna Lillahi Wa Inna ILayhi Rajioon ” के बारे में तनिक भी जानकारी नहीं है और आप इससे जुड़ा हर एक जानकारी प्राप्त करना चाहते हैं तो आप हमारे इस लेख के साथ अंत तक बने रहे। क्योंकि इस लेख में हम ” Inna Lillahi Wa Inna ILayhi Rajioon ” से जुड़ी हर एक जानकारी प्रदान करने वाले हैं तो चलिए शुरू करते हैं इस लेख को बिना देरी किए हुए।

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi | इन्ना लिल्लाही व इन्ना इलैही राजिऊन का मतलब

दोस्तों “Inna Lillahi Wa Inna ILayhi Rajioon” एक उर्दू शब्द है इसका अर्थ हिंदी भाषा में “हम अल्लाह के हैं और हमें अल्लाह के पास वापस लौट के जाना है” होता है। सरल शब्दों में कहें तो इसका अर्थ होता है कि हम अल्लाह के बंदे हैं हमें अल्लाह ने बनाया है और हमें एक ना एक दिन अल्लाह के पास वापस लौट के जाना है।

दोस्तों आपको मालूम होगा कि यह दुनिया में जितने भी सजीव प्राणी है वह एक सीमित समय के लिए धरती पर आए हुए हैं। उनका जीवनकाल कभी भी समाप्त हो सकता है जो व्यक्ति यहां पर आया है उसे जाना निश्चित है। हालांकि कुछ व्यक्ति कम समय मे ही अल्लाह के पास चले जाते है और कुछ व्यक्तियों को अल्लाह के पास जाने में कई वर्षों लग जाते हैं। यह सब अल्लाह के ऊपर निर्भर करता है, की अल्लाह किस बंदे को अपने पास कब बुलाना चाहते है।

“Inna Lillahi Wa Inna ILayhi Rajioon” शब्द अर्थ कुछ इस प्रकार से भी होता है । जैसे कि :-

- हम अल्लाह के हैं और उसी की ओर लौटेंगे ।

- अल्लाह ने हमें बनाया है और वापस हमें उनके पास जाना है।

- हम अल्लाह द्वारा भेजे गए सिपाही हैं जिन्हें वापस लौट के अल्लाह के पास जाना है।

Inna Lillahi Wa Inna ILayhi Rajioon क्या है ?

Inna Lillahi Wa Inna ILayhi Rajioon “इन्ना लिल्लाही व इन्ना इलैही राजिऊन” यह इस्लामिक समाज के पाक किताब कुरान का एक आयत है।

Inna Lillahi Wa Inna ILayhi Rajioon कब पढ़ा जाता है ?

दोस्तों हमने ऊपर के टॉपिक में जाना कि आखिर “Inna Lillahi Wa Inna ILayhi Rajioon” का मतलब क्या होता है और “Inna Lillahi Wa Inna ILayhi Rajioon In Hindi” क्या होता है। अब हम इस टॉपिक के माध्यम से जानेंगे कि आखिर “Inna Lillahi Wa Inna ILayhi Rajioon” कब पढ़ा जाता है या “Inna Lillahi Wa Inna ILayhi Rajioon” का उपयोग कब किया जाता है तो चलिए शुरू करते हैं इस टॉपिक को बिना देरी किए हुए।

जब मुस्लिम समाज में किसी भी व्यक्ति का इंतकाल हो जाता है या फिर कोई व्यक्ति किसी चहेते का इंतकाल का खबर सुनता है तब वह इस “Inna Lillahi Wa Inna ILayhi Rajioon” वाक्य का उच्चारण करता है। इन शब्दों का मतलब तो हमने आपको ऊपर में बता ही दिया है।

ऐसा जरूरी नहीं है कि जब किसी भी व्यक्ति का इंतकाल होगा तभी इस शब्द का उच्चारण किया जाएगा आप इसे अपने परेशानी के वक्त भी उपयोग कर सकते हैं। उदाहरण के तौर पर :- मान लीजिए कि आपके पास कोई फोन है या फिर आपके पास कोई कीमती चीज है और अगर आप उसे खो देते हैं तो उस परिस्थिति में भी आप इस शब्द का उच्चारण कर सकते हैं। क्योंकि इस शब्द का अर्थ ही होता है कि ” यह अल्लाह का है और इसे अल्लाह के पास ही लौटना है।

FAQ, s

Q1. inna lillahi wa in allah-e-rajioon in arabic

Ans. inna lillahi wa in allah-e-rajioon को arabic में ” إنا لله وعلينا أن نعود إلى الله ” कहते है।

Q2. inna lillahi wa in allah-e-rajioon in Urdu

Ans. inna lillahi wa in allah-e-rajioon को Urdu में ” ہم اللہ کے ہیں اور ہمیں اللہ کی طرف لوٹنا ہے۔ ” कहते है।

Q3. inna lillahi wa inallah-e-raji’oon meaning in English

Ans. inna lillahi wa inallah-e-raji’oon meaning in English is ” We surely belong to Allah and to Him we shall return “.

Watch This For More Information :-

[ Conclusion, निष्कर्ष ]

दोस्तों आशा करता हूं urstoryiq.com कि आपको मेरा यह लेख बेहद पसंद आया होगा और आप इस लेख के मदद से Inna Lillahi Wa Inna ILayhi Rajioon in hindi के बारे में जानकारी प्राप्त कर चुके होंगे।

हमने इस लेख में सरल से सरल भाषा का उपयोग करके आपको Inna Lillahi Wa Inna ILayhi Rajioon के मतलब के बारे में बताने की कोशिश की है।आप हमारे दिए गए कमेंट सेक्शन में अपनी राय जरूर दें कि आपको यह लेख कैसा लगा और आपको Inna Lillahi Wa Inna ILayhi Rajioon शब्द का अर्थ समझ में आया कि नहीं।

See also : Aas Pas Kahan-Kahan Restauant Maujud Hai

News

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं – Aas Pas Kahan-Kahan Restauant Maujud Hai

Aas Pas Kahan-Kahan Restauant Maujud Hai :- दोस्तों यदि आप भी इंटरनेट पर एक अच्छे रेस्टोरेंट की तलाश कर रहे हैं और जानना चाहते हैं कि आखिर आपके पास में कौन से सबसे अच्छे रेस्टोरेंट हैं तो हम आपको इस आर्टिकल में यही बताएंगे कि आपके आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? तो यदि आप जानना चाहते हैं और उस रेस्टोरेंट में खाना खाने जाना चाहते हैं तो इस आर्टिकल को पूरा अंत तक जरूर पड़े तभी आपको अपने पास के रेस्टोरेंट तलाश कर पाएंगे तो बिना किसी देरी के चलिए शुरू करते हैं इसलिए को और जानते हैं उन सभी रेस्टोरेंट्स ओं के बारे में जो कि आप के सबसे पास मौजूद हैं।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं?

दोस्तों यदि आप अपने आसपास के रेस्टोरेंट तलाश कर रहे हैं और जानना चाहते हैं कि आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? तो हम आपको इस टॉपिक में कुछ स्टेप्स बताएंगे जिसकी मदद से आप अपने पास के रेस्टोरेंट को तलाश कर सकते हैं तो सभी स्टेप्स को ध्यान से पढ़ें और चली जानते हैं।

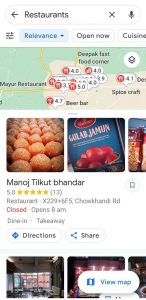

Step 1. आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं यह जानने के लिए सबसे पहले आप गूगल मैप एप्लीकेशन को ओपन करें।

Step 2. Google map एप्लीकेशन को ओपन करते हैं अब आपको उपर सर्च बॉक्स के नीचे एक रेस्टोरेंट्स का ऑप्शन दिखाई देगा।

Step 3. उस restaurant वाले ऑप्शन पर क्लिक करें। restaurant के ऑप्शन पर क्लिक करते ही अब आपके सामने एक पेज ओपन होगा।

Step 4. इस पेज में आपको आपके आसपास के सभी restaurant दिखाई देंगे जो कि गूगल पर listed होंगे। तो आप वहां देख सकते हैं कि आप के सबसे पास वाले restaurant कौन है और कौन से restaurant आपको पसंद है।

तो इस प्रकार से आप अपने पास के रेस्टोरेंट खोज सकते हैं हमें उम्मीद है कि आपको यह तरीका पसंद आया होगा और आप इस तरीका के मदद से रेस्टोरेंट को तलाश कर पाएंगे।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? (दूसरा तरीका)

Aas Pas Kahan-Kahan Restauant Maujud Hai दोस्तों यह दूसरा तरीका मैं बताऊंगा जिसके माध्यम से भी आप आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं यह जान सकते हैं और आसानी से किसी भी रेस्टोरेंट में खाने जा सकते हैं तो चलिए जानते हैं।

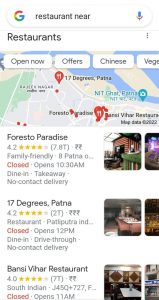

Step 1. अपने आसपास के रेस्टोरेंट जानने के लिए आपको सबसे पहले अपने मोबाइल फोन को ओपन करना है और उसके बाद गूगल में चले जाना है।

Step 2. गूगल में चले जाने के बाद अब आपको सर्च बॉक्स में restaurant near me लिखकर सर्च करना है।

Step 3. restaurant near me लिखकर सर्च करते हैं अब आपके सामने जो भी रेस्टोरेंट मौजूद होगा वह आपके मोबाइल फोन के स्क्रीन पर 400 मीटर के अंदर के सभी restaurant आ जाएगा।

Step 4. आप वहां से देख सकते हैं कि कौन रेस्टोरेंट कितना दूर है और आपके आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? और आप वहां पर देख सकते हैं कि कौन रेस्टोरेंट अभी खुला है और कौन बंद है।

दोस्तों अब हमें उम्मीद है कि अब आपको इस दूसरे तरीका के मदद से पता चल गया होगा कि आस-पास रेस्टोरेंट कहां मौजूद है और कैसे खोजा जाता है क्योंकि यह सबसे आसान तरीका था जिसकी मदद से आप अपने पास के रेस्टोरेंट को खोज सकते हैं।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? गूगल से पूछो

Aas Pas Kahan-Kahan Restauant Maujud Hai यह जानने का तीसरा और आखिरी तरीका है कि आप गूगल से पूछें कि गूगल बताओ मेरे आस-पास रेस्टोरेंट कहाँ हैं?

Step 1. तो गूगल के मदद से रेस्टोरेंट का पता जानने के लिए आप सबसे पहले गूगल असिस्टेंट को अपने मोबाइल फोन में डाउनलोड करें।

Step 2. गूगल असिस्टेंट को डाउनलोड करने के बाद अब उसे अपने मोबाइल फोन में ओपन करने के लिए आप नीचे दिए गए होम के बटन को दबाए रखें।

Step 3. उसके बाद अब आपके मोबाइल फोन में गूगल असिस्टेंट ओपन हो जाएगा अब आप गूगल असिस्टेंट से पूछे कि गूगल आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं?

यह सवाल पूछने पर अब गूगल असिस्टेंट आपको आपके आसपास के सभी रेस्टोरेंट दिखा देगा। आप वहां पर अपने मन मुताबिक किसी भी रेस्टोरेंट को चुन सकते हैं और उसके दूरी को पता लगा सकते हैं।

नजदीकी रेस्टोरेंट तक ड्राइव करके जाने का रास्ता बताओ

दोस्तों यदि आप गाड़ी से हैं और नजदीकी रेस्टोरेंट जाने के लिए ड्राइव वाली रास्ता तलाश रहे हैं तो इसके लिए आप गूगल मैप एप्लीकेशन का मदद ले सकते हैं इसमें बस आपको Google Map एप्लीकेशन को ओपन करना है और ऊपर दिए गए रेस्टोरेंट के ऑप्शन पर क्लिक कर देना है।

Aas Pas Kahan-Kahan Restauant Maujud Hai उसके बाद आपके सामने बहुत सारे रेस्टोरेंट आ जाएंगे अब आप जिस भी रेस्टोरेंट्स तक जाना चाहते हैं उस रेस्टोरेंट्स के direction वाले बटन पर क्लिक करें। direction वाले ऑप्शन पर क्लिक करते ही हैं अब आपको ड्राइव करने का वाला रास्ता दिखाई देगा। आप उस रास्ता से ड्राइव करके उस पास के रेस्टोरेंट तक जा सकते हैं।

FAQ,s

1 . क्या आस-पास में कोई मेक्सिकन रेस्टोरेंट है?

Ans :- दोस्तों यदि आप मैक्सिकन खाना खाना चाहते हैं और ढूंढ रहे हैं मेक्सिकन रेस्टोरेंट तो इसके लिए आप Google Map का इस्तेमाल कर सकते हैं। बस आपको गूगल मैप पर जाना है और सर्च बॉक्स में Mexican restaurant लिखकर सर्च कर देना है इतना करने के बाद अब आपके आसपास के मौजूद मेक्सिकन रेस्टोरेंट आ जाएगा। अब आप वहां पर जाकर मैक्सिकन खाना खा सकते हैं।

2 . आस-पास मौजूद कॉफ़ी शॉप ढूँढो

Ans:- दोस्तों यदि आपको भी कॉफ़ी दीवाने हैं और खोज रहे हैं कॉपी के सबसे पास के रेस्टोरेंट तो इसके लिए गूगल ओपन करें और उसके सर्च बारे में coffee shop near me लिखकर सर्च करें। सर्च करने के बाद अब आपके सामने आपके नजदीकी कॉफी शॉप आ जाएंगे। अब आप वहां पर जाकर कॉफी पी सकते हैं और कॉफी का मजा ले सकते हैं।

3 . गूगल आस-पास के रेस्टोरेंट बताओ?

Ans :- दोस्तों यदि आप अपने आसपास के रेस्टोरेंट पता करना चाहते हैं तो आप गूगल असिस्टेंट के माध्यम से आसानी से पता कर सकते हैं इसके लिए बस आपको गूगल असिस्टेंट को ओपन करना है और गूगल से यह सवाल पूछना है उसके बाद गूगल आपको आपके आसपास के सभी रेस्टोरेंट की list आपके सामने ला देगा।

4 . मेरे आस-पास के सबसे अच्छे रेस्टोरेंट दिखाओ

Ans :- दोस्तों अगर आप अपने आसपास के सबसे अच्छे रेस्टोरेंट खोज रहे हैं तो उसे आप गूगल से आसानी से पता कर सकते हैं बस आपको गूगल पर जाकर सर्च करना है near me best restaurant उसके बाद आपके सामने अच्छे अच्छे रेस्टोरेंट आज आएंगे जो आप के आस पास होंगे.

अंतिम विचार

दोस्तों हमें उम्मीद है urstoryiq.com कि आप इस लेख के माध्यम से अपने आसपास के सबसे नजदीकी रेस्टोरेंट को खोज पाए होंगे क्योंकि हमने इसलिए की वजह से आपको यह बता दिया हैAas Pas Kahan-Kahan Restauant Maujud Hai और हमें उम्मीद है कि आप भी जान चुके होंगे. तो यदि आप इस आर्टिकल से कुछ नया सीखे हैं तो इस आर्टिकल को दोस्तों के पास शेयर जरूर करें…धन्यवाद

See also : Buri Nazar Se Bachne Ki Dua

Business News

kya aas paas koi petrol pump hai

kya aas paas koi petrol pump hai :- दोस्तों यदि आप कहीं ऐसी जगह पर हैं जहां आप पहले कभी नहीं गए थे और आपका गाड़ी का पेट्रोल खत्म हो गया है और आप अपने आस-पास के पेट्रोल पंप खोज रहे हैं तो स्वागत है आपका इस आर्टिकल में क्योंकि इस आर्टिकल में हम आपको दो-तीन तरीका बताएंगे जिसके मदद से आप बहुत आसानी से अपने आस-पास के कोई भी पेट्रोल पंप खोज सकते हैं और वहां पर जाकर अपने गाड़ी में पेट्रोल भरवा सकते हैं। तो चलिए अब इस पोस्ट को शुरू करते हैं और जानते हैं कि क्या आस-पास कोई पेट्रोल पंप है या नही कैसे जाने।

क्या आस पास कोई पेट्रोल पंप है?

काफी बार ऐसा होता है कि हम कहीं अनजान जगह पर चले जाते हैं kya aas paas koi petrol pump hai और अचानक हमारे गाड़ी का पेट्रोल खत्म हो जाता है लेकिन हमें पता नहीं होता है कि आसपास के पेट्रोल पंप कहां है यदि आप भी इस समस्या से परेशान हैं तो चलिए हम आपको आस-पास के पेट्रोल पंप ढूंढने के सबसे आसान तरीके बताते है।

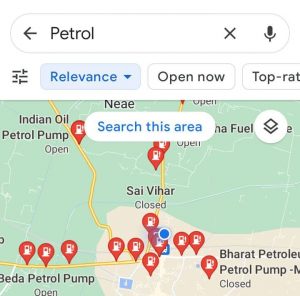

Step 1. अपने आस-पास के पेट्रोल पंप तलाशने के लिए यह सबसे पहले अपने मोबाइल फोन में गूगल मैप एप्लीकेशन को ओपन करें।

Step 2. Google Map एप्लीकेशन को ओपन करने के सीधे बाद अब लोकेशन को ऑन करें और ऊपर में दिए गए पेट्रोल पंप के आइकन पर क्लिक करें।

Step 3. petrol pump icon पर क्लिक करने के बाद अब आपके सामने आप के आस पास कोई पेट्रोल पंप के लिस्ट आ जाएंगे.

Step 4. आप वहां पर देख सकते हैं कि वहां पेट्रोल पंप कितना दूर है और आपको वहां पर जाने में कितना टाइम लगेगा

Step 5. यदि आप सीधे उस पेट्रोल पंप तक जाना चाहते हैं तो बगल में दिए गए डायरेक्शन वाले ऑप्शन पर क्लिक करें.

अब आप सीधे उस पेट्रोल पंप तक जा सकते हैं और रास्ते में या भी देख सकते हैं कि अभी पेट्रोल पंप कितना दूर है और जाने में कितना टाइम लगेगा.

कैसे जाने क्या आस पास कोई पेट्रोल पंप है?

दोस्तों यदि आपको पहला तरीका समझ में नहीं आया है kya aas paas koi petrol pump hai और तो चलिए हम आपको आस-पास के पेट्रोल पंप ढूंढने का सबसे आसान तरीका बताते हैं यह तरीका सबसे आसान तरीका है जिसकी मदद से आप बहुत आसानी से अपने आस-पास के कोई भी पेट्रोल पंप खोज सकते हैं स्टेप बाय स्टेप जानते हैं।

Step 1. सबसे पहले अपने मोबाइल फोन को ओपन करें और उसमें लोकेशन ऑन करके गूगल को ओपन करें।

Step 2. Google को ओपन करने के बाद अब उसके सर्च box में petrol pump near me लिखकर सर्च करें।

Step 3. petrol pump near me लिखकर सर्च करते हैं अब आपके सामने आपके आसपास के सभी पेट्रोल पंप के लिस्ट आ जाएंगे.

Step 4. आप बगल में दिए गए डायरेक्शन वाले ऑप्शन पर क्लिक करके सीधे उस पेट्रोल पंप तक पहुंच सकते हैं। और वहां आप यह भी पता कर सकते हैं कि उस पेट्रोल तक पहुंचने में कितना समय लगेगा।

दोस्तों इस प्रकार से आप इस दूसरे तरीका को इस्तेमाल करके अपने आसपास के मौजूद पेट्रोल पंप को तलाश कर सकते हैं और वहां जाकर अपनी गाड़ी में पेट्रोल ले सकते हैं।

Google assistant से जाने क्या आस पास कोई पेट्रोल पंप है?

दोस्तों मैं आपको बता दूं कि आप अपने आस-पास के पेट्रोल पंप खोजने के लिए डायरेक्ट गूगल असिस्टेंट से भी पूछ सकते हैं तो चलिए जानते हैं kya aas paas koi petrol pump hai कैसे गूगल असिस्टेंट से अपने आस-पास के पेट्रोल पंप पर पता किया जा सकता है।

Step 1. अपने आस-पास के पेट्रोल पंप खोजने के लिए सबसे पहले आप अपने लोकेशन को ऑन करें और गूगल असिस्टेंट एप्लीकेशन को ओपन करें।

Step 2. गूगल असिस्टेंट ओपन करने के लिए आप अपने मोबाइल फोन के होम के बटन को टाइप किए रखें उसके बाद आपको गूगल असिस्टेंट ओपन हो जाएगा।

Step 3. गूगल असिस्टेंट ओपन हो जाने के बाद अब आप अब बोले कि गूगल क्या आस-पास कोई पेट्रोल पंप है। यह बोलते ही गूगल असिस्टेंट आपको आपके आसपास के सभी पेट्रोल पंप का लिस्ट ला देगा।

रिलायंस पेट्रोल पंप की दूरी

यदि आप रिलायंस के पेट्रोल पंप पर जाकर पेट्रोल देना चाहते हैं और जानना चाहते हैं कि यहां से रिलायंस पेट्रोल पंप की दूरी कितनी है तो इसके लिए आपको सबसे पहले अपने मोबाइल में गूगल को ओपन करना होगा और search box में Reliance petrol pump near me लिखकर सर्च करना होगा उसके बाद अब आपके सामने नजदीकी रिलायंस के पेट्रोल पंप आ जाएंगे और आप वहां पर आसानी से देख सकते हैं कि रिलायंस की पेट्रोल पंप की दूरी कितनी है।

यहां से पेट्रोल पंप कितनी दूरी पर है?

दोस्तों यदि आप पता करना चाहते हैं कि यहां से कोई भी पेट्रोल पंप कितनी दूरी पर है तो इसके लिए आप सबसे पहले अपने मोबाइल फोन में Google Map एप्लीकेशन को ओपन करें और अपने location को ऑन करें। उसके बाद अब आप petrol pump के icon पर क्लिक करें इतना करने के बाद अब आप के आस पास के पेट्रोल पंप आ जाएगी और साथ-साथ उसकी दूरी भी वहां पर लिखी होगी।

FAQ

1. आस पास के पेट्रोल पंप के बारे में कैसे जाने?

दोस्तों यदि आप अपने आस-पास के पेट्रोल पंप के बारे में जानना चाहते हैं तो इसके लिए आप गूगल पर सर्च कर सकते हैं petrol pump near me और अपने आसपास में मौजूद सभी पेट्रोल पंप के बारे में जान सकते हैं।

2. आप पास के पेट्रोल पंप कैसे ढूंढे?

अपने आस-पास के पेट्रोल पंप ढूंढने के लिए सबसे पहले आप गूगल को ओपन करें और सर्च बॉक्स में nearest petrol pump लिखकर सर्च करें इतना करने के बाद आप के आस पास के पेट्रोल पंप के सामने आ जाएंगे.

3 .अपने आस पास के पेट्रोल पंप को ढूंढने के तरीके?

दोस्तों मैं आपको बता दूं कि अपने आस पास के पेट्रोल पंप ढूंढने के कुल 3 तारीख का है पहला आप Google Map Application से पेट्रोल पंप खोज सकते हैं इसके दूसरा तरीका है आप Google assistant से पूछ कर पास के पेट्रोल पंप खोज सकते हैं और तीसरा तरीका है कि आप गूगल पर सर्च करके अपने आस-पास के पेट्रोल पंप खोज सकते हैं।

अंतिम विचार

kya aas paas koi petrol pump hai दोस्तों हमें उम्मीद है urstoryiq.com कि आपको यह आर्टिकल पसंद आया होगा और आप इस आर्टिकल के मदद से अपने आस-पास के पेट्रोल पंप खोज पाए होंगे क्योंकि हम इस पोस्ट में आपको बताया है कि आप कैसे अपने आस-पास के कोई भी पेट्रोल पंप खोज सकते हैं और वहां जाकर पेट्रोल ले सकते हैं तो इन्हीं सभी जानकारियों के साथ चलिए अब इस लेख को यहीं पर समाप्त करते हैं..धन्यवाद

See also : WFM Full Form

-

Technology6 years ago

Developing Workplace Face Recognition Devices and Controls

-

Business News5 years ago

Business News5 years agoFacts to know about commercial closing

-

Home Advice6 years ago

Things to Remember When Shopping For Recycled Plastic Adirondack Chairs

-

Technology6 years ago

Use WhatsApp Web Login on PC

-

Entertainment6 years ago

Meanings of WhatsApp Symbols, Emoticons

-

Education5 years ago

Education5 years agoHuman Body And Its Interesting Features

-

Entertainment6 years ago

Ganesh Chaturthi Songs (Mp3, DJ Songs, Remix) Ganpati Songs Free Download

-

Sports News4 years ago

Sports News4 years agoHow to Build a Perfect Fantasy Cricket Team?