Business News

14 Valid Ways to Convert Black Money to White

Converting black money to white

With the sudden governmental actions taken to curb black money circulation, many big shots of the country are facing the pressures of converting all illegally acquired wealth to white cash. Before proceeding further, it is important to understand what exactly black money is. Black money in the Indian economy refers to the money that is earned in the black market, that is, the money on which the individual does not pay taxes to the government. This is illegal and punishable under the law. This is perhaps why the black money recipients tend to hide such facts and spend this money in cash instead of other forms of banking transactions.

Though absolutely not advisable, there are certain loopholes in our economic system that makes it possible for black money to be converted to white money. These are perhaps the opportunities that black money recipients might use currently in order to overcome the government regulations against illegal money. Some commonly used practices include,

-

Charity donations

With excess money to be converted from black to white in hand, most people would prefer donating lavishly to orphanages, old age homes and other charitable organizations. The amount is generally paid in cash form, without any receipt requirement. Some organizations may also take direct deposits to their organizations account as well. This helps the person clear off black money as well earn praises from society for helping the needy.

-

Give it to the needy

This is perhaps the easiest way to get rid of black money. Passing on some money to someone in need or someone who is financially not sound enough can help the person live a better life and the donating person some peace of mind.

-

Invest in expensive valuable

With lots of hard cash in hand, it is common for people to buy high value goods to convert the black money to white. This may include buying a new property, land or flat, a new car or any other expensive good. The buyer generally requests for a back dated bill from the seller to cover up the ploy.

-

Set up a new start up

This is the best time to give wings to new ideas in the form of new business ventures. Setting a new company requires ample investments. This allows black money to be utilized fruitfully and also establish a start up company to avoid the eyes of the tax department.

-

Loan out to others on low interest rates

Another easy way to convert black money to white is passing on some amount as a loan to others while charging a really low interest rate of may be 1-2 %. This offer is lucrative enough for others to take up the loan and a way out for black money recipients during this period of crisis.

-

Invest into various sectors of finance

One can easily invest large amounts on various sectors of finance. They can buy new insurance policies of higher values and invest in mutual funds. This investment makes it possible for black money to be utilized profitably.

-

Advance payments

Businessmen can pass on large amounts of black money in the form of advance salary payments to employees. Appraisals and bonus paid to employees keep the staff happy and satisfied while the employer can get away without paying taxes on large illegally acquired cash.

-

Cough up taxes

The recipient can pay up taxes on some portions of the acquired black money in order to avoid the eyes of the Income Tax department in terms of the rest of the money, which can be an atrocious amount for the government officials.

-

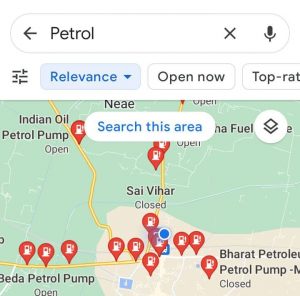

Fill up on fuel

With fuel stations taking old notes and cars always requiring fuel, black money recipients can stack up on fuel like petrol and diesel in bulk quantities. Though this is a risky option, with the law over their heads, black money recipients are more likely to take up the risk in the current situation.

-

Income as Agriculture Income

Another popular way of converting black money to white is by showing the income amount as agriculture income. This is possible only when the person possess any land. If not, then the primary task is to acquire large areas of land. This land is then used for agriculture purposes like small scale plantations, gardening, farming and setting up nurseries.

-

Cash Income from Profession

One of the most popular options of converting black money to white is simply showing the cash income as payment from profession. This can be from professional income from tuition to students, and professional fees or commission for education related issues.

-

Stacking on liquor

Big businessmen can plan of stacking large quantities of highly expensive liquor and other alcoholic drinks. This can be shown as required for personal parties and other events. This helps spend the black money in the form of white cash

-

Lavish shopping soiree

Big large amounts of liquid cash in hand, though black money, people can easily spend up on lavish shopping trips to the malls. Purchasing expensive shoes, clothes, household items, accessories, make up items and other home products can help get rid of illegal funds.

-

Expensive holidays

One can relax and unwind with family and friends on a vacation to exotic locations. The holiday reservations can be paid using the black money cash fund. This way one gets to enjoy, have a nice time and also be stress-free in terms of tax-free money.

These are probably only few of the possible ways to convert black money to white. Black money recipients would probably be thinking of several other ways to overcome government regulations and get away with illegal money.

Disclaimer –

We don’t recommend readers to follow any of these methods for black money conversion. This article is just for exposing loop holes of our system. So, that RBI and the government can take appropriate action by formulating strict rules to remove black money from India. We are against black money and black money generation ideas.

If we have missed any other methods which people use to convert their black money into white money we’ll request you to share it in comment sec.

Business News

Uber Alternatives: 10 Ride-Sharing & Similar Applications

With online cab booking services becoming an integral part of our lives, Uber Alternatives has introduced the service that has dominated the market since its introduction. With vast cab services and taxes being made in cities and countries worldwide, Uber has ranked in the cab market with one of the largest services.

Although Uber has been rated as one of the largest cab booking services, it lacks some of its features like Uber Driver, Surge Pricing, automated system, and a couple of others. Hence, for your convenience, in this article, we have mentioned the 10 alternatives of Uber that can help you choose the best cab services.

What is Uber Alternatives ?

Uber Technologies, is a multinational transportation company that is incorporated with services like raid-hailing services, food delivery, freight transportation, and courier services.

Founded in 2009, Garrett Camp came up with the idea to create Uber and spent $800 hiring a private driver on the business eve.

With the largest ridesharing company worldwide with more than 150 million monthly active users and more than 6 million drivers, Uber guarantees to facilitate more than 26 million rides a day and more than 46 billion drives since its foundation in 2010.

How Uber Will Face Challenges in The Upcoming Years?

Although Uber is an esteemed company that has provided cab services for years, its reputation has gradually declined in recent years owing to the several challenges they are facing or is likely to face shortly.

1. Status of Drivers

One of them is the status of drivers; whether they are classified as personnel or independent drivers. Uber, to maintain its safe side, opts for the latter, and classifies itself as a technology company whose sole purpose is to connect drivers and passengers.

Although this classification works smoothly for the company and some of the drivers, others have reported to be suffering from it. Many drivers claim that they have been paid minimum wages which do not meet the earnings they can do by working as independent drivers. Not only this, but the company, Uber, has been solving several lawsuits that have been launched by drivers in Massachusetts and California.

2. The California Controversy

The ongoing challenges with the status of drivers faced legislative challenges in California; the region’s population of 39 million makes it one of the largest marketplaces for the company. Following, in 2019, the California senate passed an Assembly Bill 5, that ordered Uber, and Lyft among other ridesharing to deal with their drivers as employees and not independent contractors.

3. Taxes

Another issue that is related to the status of the drivers is the tax issue. If Uber stops claiming itself as a technology company and becomes a livery company, the government can claim that the entire ride payment is Uber Alternatives revenue and is subjected to taxes and governance.

4. Driver’s Risk

Besides, Uber drivers have been subjected to several risks as the company has been banned in several regions. In such cases, Uber drivers are open to receiving threats from the regions and their independent drivers.

Additionally, the Airport authorities have also been cracking down on Uber to drop off and pick up customers from the airport.

5. The Risk of International Expansion

Since Uber has now expanded its services and is now available across Asian countries, it might face issues with the local drivers.

Not only has there been an urge to promote local businesses, but the taxis are more affordable and compatible with customers. In such cases, Uber’s global expansion has sought to arouse several challenges in recent years.

10 Best Uber Alternatives In 2024

1. Flywheel

A cab-related service, similar to Uber, is currently working in San Francisco and is also one of the oldest cab services in the area. Flywheel, unlike Uber, is positively reviewed for its well-behaved drivers and clean cats.

Besides cab services, they have the second largest fleet of wheel car-based taxis and drivers that are trained for ease to passengers.

2. Grab

A Southeast Asian application, Grab is a great alternative to Uber Alternatives; however, has a plethora of features to offer. Initiated in Malaysia in 2012, besides its cab services, the company offers food and grocery delivery services, and mobile payments among others. With a simplified user interface and customer service assistance, Grab, with few taps, offers you a plethora of services that include purchasing groceries, ordering food, and much more.

Currently, Grab is operating its services in more than 400 cities. Additionally, Grab supports local businesses by including a list of restaurants and grocery stores that provide with several services to users.

3. HopSkipDrive

With considerable transportation that provides services to children and older adults. Currently operating in the United States in its 13 states, it currently operates primarily for school-aged children who fall under the category of IEP or the McKinney – Vento Homeless Assistance Act.

4. Bolt

Bolt, founded in 2013 in Estonia as Taxify is a transportation network organisation that operates in over 50 nations internationally. It offers convenient and low-cost experience hailing offerings to its customers. The organisation focuses on offering competitive pricing for its rides. The pricing model of the enterprise is designed in such a manner it is low-priced for both the riders and the drivers. The well-represented application allows customers to e-book rides, music their motive force’s place and pay for the rides seamlessly. Bolt is dedicated to safety and has implemented several measures to ensure the proper being of its riders and drivers.

One of the excellent Uber Alternatives options alternatives for commuters and vacationers in numerous countries including Europe, Africa, Asia and Latin America. Bolt can be a beneficial alternative to Uber if you are looking for an alternative to Uber with a motive of transportation for your family and education. The core values that are posed by Bolt are safety, empathy, ownership, thinking a bigger hustle, a brighter tomorrow, and positivity.

5. Gett

An Israeli company, Gett, with its established features and an easy interface, has made itself popular in the cab and taxi-sharing market.

Initially, the app was named GetTaxi and the only services it provided were related to taxis. However, with its globalisation, Gett also includes B2B travel management that shows versatility in its plethora of operations.

As of 2024, Gett has a strong presence in the United States, United Kingdom, and Israel. Now, with its appropriate corporate offerings, Gett is ready to expand itself in other markets across the globe.

6. OLA

An Indian multinational ride-sharing company, the term ‘OLA’ is styled as OLΛ. With its headquarters in Bengaluru, India, in 2010, the company was initiated as a trip-planning company. However, in 2011, with the growing market of cab-related services, its founder, Bhavesh Agarwal, decided to make a smooth transition that eventually led him to a successful way to gain a global market share.

Now as of 2024, OLA has not only expanded its service in India but also in several countries including Australia, New Zealand, and The United Kingdom.

7. Wingz

Besides its services of allowing users to book prior, its charges are fixed which helps users in not receiving a surge fee after arriving at the airport.

A US-based ride-hailing service, Wingz predominantly serves pre-scheduled, flat-fee, private rides that are particular for airport transfers.

Not only this, but Wingz lets riders and users request their favourite drivers for a hassle-free drive. With a safety feature and several customisation options, it serves as a great alternative to Uber Alternatives in 2024.

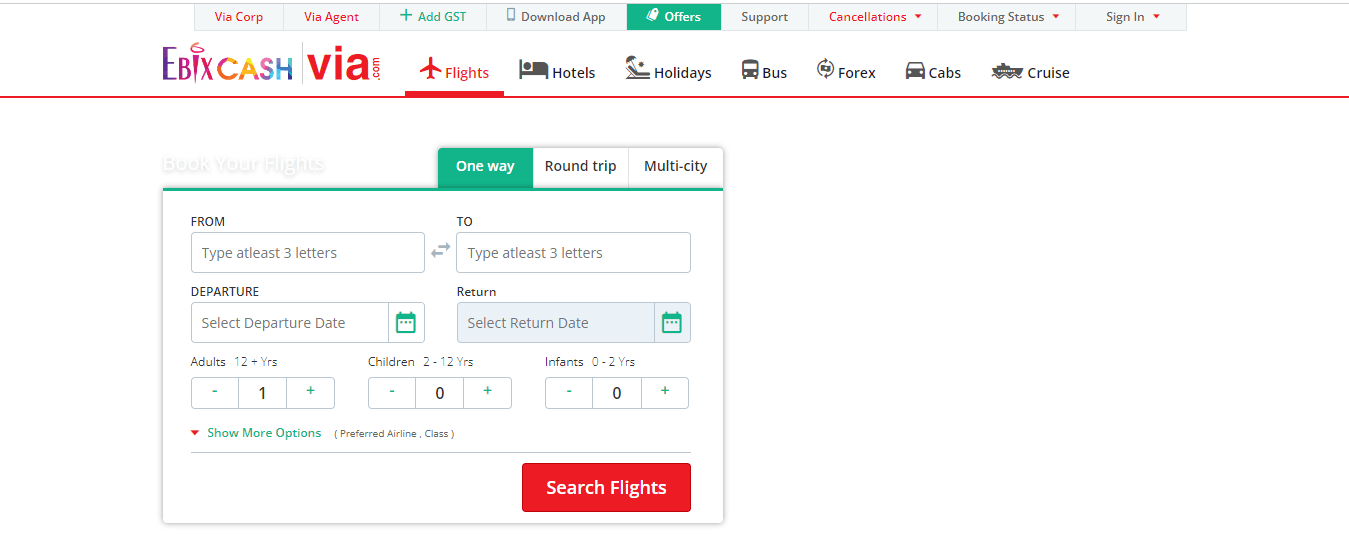

8. Via

A New York-based company, Via has now expanded its service globally and operates in more than 20 countries with its unique, ride-sharing opportunities.

Via uses an algorithm that matches passengers that are heading in the same direction which helps reduce the number of cars on the road while lowering the cost of a person. Additionally, with its unique ride-sharing option, it can be counted as one of the most sustainable Uber substitutes in the market.

9. Cabify

Operated mainly by a Spanish ride company, Cabify operates mainly in Spain, Latin America, and a few parts of Europe.

While the company is committed to safety, Cabify represents a comfortable drive to its customers, transparent pricing, and high-quality and trained drivers. Unlike Uber Alternatives, Cabify has reported few safety incidents and is continuing to improve to provide more safe services. While Cabify is safely running in regions across Spain, Latin America, and regions of Europe, it is constantly working to expand its services across Asian regions.

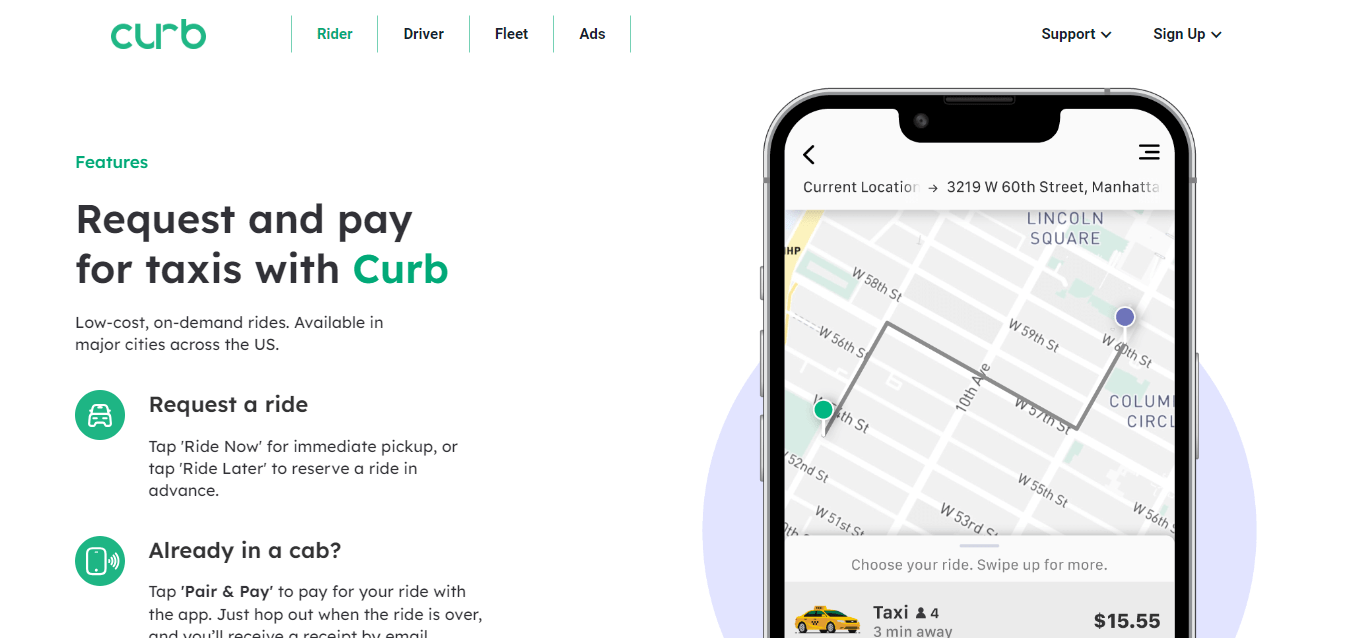

10. Curb

A US-based company that connects with riders and professional drivers, Curb is another reliable alternative to Uber.

With its new age reliability of tech-led Taxi applications, it combined the traditional taxis, which is why it is considered unique.

Along with its instant service, Curb also allows users to book their taxis in advance. In collaboration with the old taxis, Curb is supporting old-school businesses and local employees that can cash on modern-day cab services.

Final Words

Uber, urstoryiq.com with more than 47 billion rides since its inception in 2010, is likely to continue its contribution to the ride-sharing business. However, owing to several legal actions and controversies emerging around Uber Alternatives name have sabotaged its established market. In such cases, many users and customers have preferably switched their platforms to a safer and less controversial ride-sharing and cab services application.

Hence, if you are also looking for an alternative ride-hailing service to Uber, you can prefer our above-mentioned much-coveted guide. In this guide, we have covered everything including the reasons Uber is facing a setback from its customers, users, and drivers, and also the 10 alternatives of Uber in 2024 that can be used for a safer ride.

See also : From Me To You: Kimi Ni Todoke Season 3 Renewed At Netflix

News

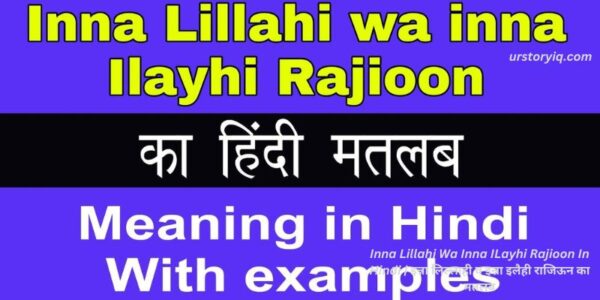

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi | इन्ना लिल्लाही व इन्ना इलैही राजिऊन का मतलब

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi :- दोस्तों आपने कभी ना कभी मुसलमान समाज के लोगों को ” Inna Lillahi Wa Inna ILayhi Rajioon ” कहते अवश्य सुना होगा और आपके मन में यह ख्याल आया होगा कि आखिर ” Inna Lillahi Wa Inna ILayhi Rajioon ” क्या है और ” Inna Lillahi Wa Inna ILayhi Rajioon ” का उच्चारण कब किया जाता है या फिर ” Inna Lillahi Wa Inna ILayhi Rajioon ” को कब पढ़ा जाता है।

अगर आपको ” Inna Lillahi Wa Inna ILayhi Rajioon ” के बारे में तनिक भी जानकारी नहीं है और आप इससे जुड़ा हर एक जानकारी प्राप्त करना चाहते हैं तो आप हमारे इस लेख के साथ अंत तक बने रहे। क्योंकि इस लेख में हम ” Inna Lillahi Wa Inna ILayhi Rajioon ” से जुड़ी हर एक जानकारी प्रदान करने वाले हैं तो चलिए शुरू करते हैं इस लेख को बिना देरी किए हुए।

Inna Lillahi Wa Inna ILayhi Rajioon In Hindi | इन्ना लिल्लाही व इन्ना इलैही राजिऊन का मतलब

दोस्तों “Inna Lillahi Wa Inna ILayhi Rajioon” एक उर्दू शब्द है इसका अर्थ हिंदी भाषा में “हम अल्लाह के हैं और हमें अल्लाह के पास वापस लौट के जाना है” होता है। सरल शब्दों में कहें तो इसका अर्थ होता है कि हम अल्लाह के बंदे हैं हमें अल्लाह ने बनाया है और हमें एक ना एक दिन अल्लाह के पास वापस लौट के जाना है।

दोस्तों आपको मालूम होगा कि यह दुनिया में जितने भी सजीव प्राणी है वह एक सीमित समय के लिए धरती पर आए हुए हैं। उनका जीवनकाल कभी भी समाप्त हो सकता है जो व्यक्ति यहां पर आया है उसे जाना निश्चित है। हालांकि कुछ व्यक्ति कम समय मे ही अल्लाह के पास चले जाते है और कुछ व्यक्तियों को अल्लाह के पास जाने में कई वर्षों लग जाते हैं। यह सब अल्लाह के ऊपर निर्भर करता है, की अल्लाह किस बंदे को अपने पास कब बुलाना चाहते है।

“Inna Lillahi Wa Inna ILayhi Rajioon” शब्द अर्थ कुछ इस प्रकार से भी होता है । जैसे कि :-

- हम अल्लाह के हैं और उसी की ओर लौटेंगे ।

- अल्लाह ने हमें बनाया है और वापस हमें उनके पास जाना है।

- हम अल्लाह द्वारा भेजे गए सिपाही हैं जिन्हें वापस लौट के अल्लाह के पास जाना है।

Inna Lillahi Wa Inna ILayhi Rajioon क्या है ?

Inna Lillahi Wa Inna ILayhi Rajioon “इन्ना लिल्लाही व इन्ना इलैही राजिऊन” यह इस्लामिक समाज के पाक किताब कुरान का एक आयत है।

Inna Lillahi Wa Inna ILayhi Rajioon कब पढ़ा जाता है ?

दोस्तों हमने ऊपर के टॉपिक में जाना कि आखिर “Inna Lillahi Wa Inna ILayhi Rajioon” का मतलब क्या होता है और “Inna Lillahi Wa Inna ILayhi Rajioon In Hindi” क्या होता है। अब हम इस टॉपिक के माध्यम से जानेंगे कि आखिर “Inna Lillahi Wa Inna ILayhi Rajioon” कब पढ़ा जाता है या “Inna Lillahi Wa Inna ILayhi Rajioon” का उपयोग कब किया जाता है तो चलिए शुरू करते हैं इस टॉपिक को बिना देरी किए हुए।

जब मुस्लिम समाज में किसी भी व्यक्ति का इंतकाल हो जाता है या फिर कोई व्यक्ति किसी चहेते का इंतकाल का खबर सुनता है तब वह इस “Inna Lillahi Wa Inna ILayhi Rajioon” वाक्य का उच्चारण करता है। इन शब्दों का मतलब तो हमने आपको ऊपर में बता ही दिया है।

ऐसा जरूरी नहीं है कि जब किसी भी व्यक्ति का इंतकाल होगा तभी इस शब्द का उच्चारण किया जाएगा आप इसे अपने परेशानी के वक्त भी उपयोग कर सकते हैं। उदाहरण के तौर पर :- मान लीजिए कि आपके पास कोई फोन है या फिर आपके पास कोई कीमती चीज है और अगर आप उसे खो देते हैं तो उस परिस्थिति में भी आप इस शब्द का उच्चारण कर सकते हैं। क्योंकि इस शब्द का अर्थ ही होता है कि ” यह अल्लाह का है और इसे अल्लाह के पास ही लौटना है।

FAQ, s

Q1. inna lillahi wa in allah-e-rajioon in arabic

Ans. inna lillahi wa in allah-e-rajioon को arabic में ” إنا لله وعلينا أن نعود إلى الله ” कहते है।

Q2. inna lillahi wa in allah-e-rajioon in Urdu

Ans. inna lillahi wa in allah-e-rajioon को Urdu में ” ہم اللہ کے ہیں اور ہمیں اللہ کی طرف لوٹنا ہے۔ ” कहते है।

Q3. inna lillahi wa inallah-e-raji’oon meaning in English

Ans. inna lillahi wa inallah-e-raji’oon meaning in English is ” We surely belong to Allah and to Him we shall return “.

Watch This For More Information :-

[ Conclusion, निष्कर्ष ]

दोस्तों आशा करता हूं urstoryiq.com कि आपको मेरा यह लेख बेहद पसंद आया होगा और आप इस लेख के मदद से Inna Lillahi Wa Inna ILayhi Rajioon in hindi के बारे में जानकारी प्राप्त कर चुके होंगे।

हमने इस लेख में सरल से सरल भाषा का उपयोग करके आपको Inna Lillahi Wa Inna ILayhi Rajioon के मतलब के बारे में बताने की कोशिश की है।आप हमारे दिए गए कमेंट सेक्शन में अपनी राय जरूर दें कि आपको यह लेख कैसा लगा और आपको Inna Lillahi Wa Inna ILayhi Rajioon शब्द का अर्थ समझ में आया कि नहीं।

See also : Aas Pas Kahan-Kahan Restauant Maujud Hai

News

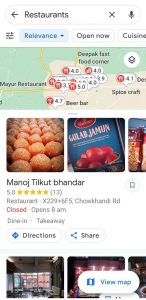

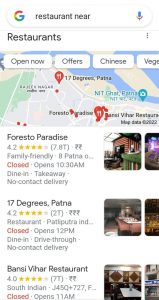

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं – Aas Pas Kahan-Kahan Restauant Maujud Hai

Aas Pas Kahan-Kahan Restauant Maujud Hai :- दोस्तों यदि आप भी इंटरनेट पर एक अच्छे रेस्टोरेंट की तलाश कर रहे हैं और जानना चाहते हैं कि आखिर आपके पास में कौन से सबसे अच्छे रेस्टोरेंट हैं तो हम आपको इस आर्टिकल में यही बताएंगे कि आपके आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? तो यदि आप जानना चाहते हैं और उस रेस्टोरेंट में खाना खाने जाना चाहते हैं तो इस आर्टिकल को पूरा अंत तक जरूर पड़े तभी आपको अपने पास के रेस्टोरेंट तलाश कर पाएंगे तो बिना किसी देरी के चलिए शुरू करते हैं इसलिए को और जानते हैं उन सभी रेस्टोरेंट्स ओं के बारे में जो कि आप के सबसे पास मौजूद हैं।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं?

दोस्तों यदि आप अपने आसपास के रेस्टोरेंट तलाश कर रहे हैं और जानना चाहते हैं कि आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? तो हम आपको इस टॉपिक में कुछ स्टेप्स बताएंगे जिसकी मदद से आप अपने पास के रेस्टोरेंट को तलाश कर सकते हैं तो सभी स्टेप्स को ध्यान से पढ़ें और चली जानते हैं।

Step 1. आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं यह जानने के लिए सबसे पहले आप गूगल मैप एप्लीकेशन को ओपन करें।

Step 2. Google map एप्लीकेशन को ओपन करते हैं अब आपको उपर सर्च बॉक्स के नीचे एक रेस्टोरेंट्स का ऑप्शन दिखाई देगा।

Step 3. उस restaurant वाले ऑप्शन पर क्लिक करें। restaurant के ऑप्शन पर क्लिक करते ही अब आपके सामने एक पेज ओपन होगा।

Step 4. इस पेज में आपको आपके आसपास के सभी restaurant दिखाई देंगे जो कि गूगल पर listed होंगे। तो आप वहां देख सकते हैं कि आप के सबसे पास वाले restaurant कौन है और कौन से restaurant आपको पसंद है।

तो इस प्रकार से आप अपने पास के रेस्टोरेंट खोज सकते हैं हमें उम्मीद है कि आपको यह तरीका पसंद आया होगा और आप इस तरीका के मदद से रेस्टोरेंट को तलाश कर पाएंगे।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? (दूसरा तरीका)

Aas Pas Kahan-Kahan Restauant Maujud Hai दोस्तों यह दूसरा तरीका मैं बताऊंगा जिसके माध्यम से भी आप आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं यह जान सकते हैं और आसानी से किसी भी रेस्टोरेंट में खाने जा सकते हैं तो चलिए जानते हैं।

Step 1. अपने आसपास के रेस्टोरेंट जानने के लिए आपको सबसे पहले अपने मोबाइल फोन को ओपन करना है और उसके बाद गूगल में चले जाना है।

Step 2. गूगल में चले जाने के बाद अब आपको सर्च बॉक्स में restaurant near me लिखकर सर्च करना है।

Step 3. restaurant near me लिखकर सर्च करते हैं अब आपके सामने जो भी रेस्टोरेंट मौजूद होगा वह आपके मोबाइल फोन के स्क्रीन पर 400 मीटर के अंदर के सभी restaurant आ जाएगा।

Step 4. आप वहां से देख सकते हैं कि कौन रेस्टोरेंट कितना दूर है और आपके आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? और आप वहां पर देख सकते हैं कि कौन रेस्टोरेंट अभी खुला है और कौन बंद है।

दोस्तों अब हमें उम्मीद है कि अब आपको इस दूसरे तरीका के मदद से पता चल गया होगा कि आस-पास रेस्टोरेंट कहां मौजूद है और कैसे खोजा जाता है क्योंकि यह सबसे आसान तरीका था जिसकी मदद से आप अपने पास के रेस्टोरेंट को खोज सकते हैं।

आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं? गूगल से पूछो

Aas Pas Kahan-Kahan Restauant Maujud Hai यह जानने का तीसरा और आखिरी तरीका है कि आप गूगल से पूछें कि गूगल बताओ मेरे आस-पास रेस्टोरेंट कहाँ हैं?

Step 1. तो गूगल के मदद से रेस्टोरेंट का पता जानने के लिए आप सबसे पहले गूगल असिस्टेंट को अपने मोबाइल फोन में डाउनलोड करें।

Step 2. गूगल असिस्टेंट को डाउनलोड करने के बाद अब उसे अपने मोबाइल फोन में ओपन करने के लिए आप नीचे दिए गए होम के बटन को दबाए रखें।

Step 3. उसके बाद अब आपके मोबाइल फोन में गूगल असिस्टेंट ओपन हो जाएगा अब आप गूगल असिस्टेंट से पूछे कि गूगल आस-पास कहाँ-कहाँ रेस्टोरेंट मौजूद हैं?

यह सवाल पूछने पर अब गूगल असिस्टेंट आपको आपके आसपास के सभी रेस्टोरेंट दिखा देगा। आप वहां पर अपने मन मुताबिक किसी भी रेस्टोरेंट को चुन सकते हैं और उसके दूरी को पता लगा सकते हैं।

नजदीकी रेस्टोरेंट तक ड्राइव करके जाने का रास्ता बताओ

दोस्तों यदि आप गाड़ी से हैं और नजदीकी रेस्टोरेंट जाने के लिए ड्राइव वाली रास्ता तलाश रहे हैं तो इसके लिए आप गूगल मैप एप्लीकेशन का मदद ले सकते हैं इसमें बस आपको Google Map एप्लीकेशन को ओपन करना है और ऊपर दिए गए रेस्टोरेंट के ऑप्शन पर क्लिक कर देना है।

Aas Pas Kahan-Kahan Restauant Maujud Hai उसके बाद आपके सामने बहुत सारे रेस्टोरेंट आ जाएंगे अब आप जिस भी रेस्टोरेंट्स तक जाना चाहते हैं उस रेस्टोरेंट्स के direction वाले बटन पर क्लिक करें। direction वाले ऑप्शन पर क्लिक करते ही हैं अब आपको ड्राइव करने का वाला रास्ता दिखाई देगा। आप उस रास्ता से ड्राइव करके उस पास के रेस्टोरेंट तक जा सकते हैं।

FAQ,s

1 . क्या आस-पास में कोई मेक्सिकन रेस्टोरेंट है?

Ans :- दोस्तों यदि आप मैक्सिकन खाना खाना चाहते हैं और ढूंढ रहे हैं मेक्सिकन रेस्टोरेंट तो इसके लिए आप Google Map का इस्तेमाल कर सकते हैं। बस आपको गूगल मैप पर जाना है और सर्च बॉक्स में Mexican restaurant लिखकर सर्च कर देना है इतना करने के बाद अब आपके आसपास के मौजूद मेक्सिकन रेस्टोरेंट आ जाएगा। अब आप वहां पर जाकर मैक्सिकन खाना खा सकते हैं।

2 . आस-पास मौजूद कॉफ़ी शॉप ढूँढो

Ans:- दोस्तों यदि आपको भी कॉफ़ी दीवाने हैं और खोज रहे हैं कॉपी के सबसे पास के रेस्टोरेंट तो इसके लिए गूगल ओपन करें और उसके सर्च बारे में coffee shop near me लिखकर सर्च करें। सर्च करने के बाद अब आपके सामने आपके नजदीकी कॉफी शॉप आ जाएंगे। अब आप वहां पर जाकर कॉफी पी सकते हैं और कॉफी का मजा ले सकते हैं।

3 . गूगल आस-पास के रेस्टोरेंट बताओ?

Ans :- दोस्तों यदि आप अपने आसपास के रेस्टोरेंट पता करना चाहते हैं तो आप गूगल असिस्टेंट के माध्यम से आसानी से पता कर सकते हैं इसके लिए बस आपको गूगल असिस्टेंट को ओपन करना है और गूगल से यह सवाल पूछना है उसके बाद गूगल आपको आपके आसपास के सभी रेस्टोरेंट की list आपके सामने ला देगा।

4 . मेरे आस-पास के सबसे अच्छे रेस्टोरेंट दिखाओ

Ans :- दोस्तों अगर आप अपने आसपास के सबसे अच्छे रेस्टोरेंट खोज रहे हैं तो उसे आप गूगल से आसानी से पता कर सकते हैं बस आपको गूगल पर जाकर सर्च करना है near me best restaurant उसके बाद आपके सामने अच्छे अच्छे रेस्टोरेंट आज आएंगे जो आप के आस पास होंगे.

अंतिम विचार

दोस्तों हमें उम्मीद है urstoryiq.com कि आप इस लेख के माध्यम से अपने आसपास के सबसे नजदीकी रेस्टोरेंट को खोज पाए होंगे क्योंकि हमने इसलिए की वजह से आपको यह बता दिया हैAas Pas Kahan-Kahan Restauant Maujud Hai और हमें उम्मीद है कि आप भी जान चुके होंगे. तो यदि आप इस आर्टिकल से कुछ नया सीखे हैं तो इस आर्टिकल को दोस्तों के पास शेयर जरूर करें…धन्यवाद

See also : Buri Nazar Se Bachne Ki Dua

-

Technology6 years ago

Developing Workplace Face Recognition Devices and Controls

-

Business News5 years ago

Business News5 years agoFacts to know about commercial closing

-

Home Advice6 years ago

Things to Remember When Shopping For Recycled Plastic Adirondack Chairs

-

Technology6 years ago

Use WhatsApp Web Login on PC

-

Entertainment6 years ago

Meanings of WhatsApp Symbols, Emoticons

-

Education5 years ago

Education5 years agoHuman Body And Its Interesting Features

-

Entertainment6 years ago

Ganesh Chaturthi Songs (Mp3, DJ Songs, Remix) Ganpati Songs Free Download

-

Sports News4 years ago

Sports News4 years agoHow to Build a Perfect Fantasy Cricket Team?